hotel tax calculator illinois

Except as noted on their respective pages the preprinted rate on the return will include any. The Hotel Accommodations Tax remains 45.

Taxation Software Tax Deducted At Source Due Date Payroll

Illinois Income Tax Calculator 2021 If you make 70000 a year living in the region of Illinois USA you will be taxed 11737.

. FormFiling Payment Requirements The tax is reported on Form RHM-1 Hotel Operators Occupation Tax Return. Call our TDD telecommunications device for the deaf at 1 800 544-5304. Hotel tax calculator illinois Sunday June 12 2022 FedRooms provides federal travelers on official business with FTR compliant hotel rooms for transient and extended stays.

0100 Only In Your State Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. Just enter in the required info below such as wage. Name Description MyTax Illinois.

After a few seconds you will be provided with a full breakdown of the. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Call us at 217 782-6045.

Matrix does not address the City of Chicago taxes that are enforced by the Illinois Department of Revenue. Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Ad Finding hotel tax by state then manually filing is time consuming.

All other hotels with. If filing a tax period prior to April 2011 call 217 785 6606 to obtain the correct form. Your average tax rate is 1198 and your marginal tax rate is 22.

As a reminder the Surcharge rate is 6 as of 12118. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus. 54 rows 3 State levied lodging tax varies.

1 Transient Rooms Revenue - Sleeping Rooms Y Hotel. Ad Finding hotel tax by state then manually filing is time consuming. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Hotel Operators Occupation Tax Return R-0513 NOTE. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Avalara automates lodging sales and use tax compliance for your hospitality business.

Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. The wage base is. Write us at Illinois Department of Revenue Miscellaneous Taxes Division PO.

Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. 54 rows Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160 rooms. Local Hotel Taxes The following local taxes which the department collects may be imposed.

Avalara automates lodging sales and use tax compliance for your hospitality business. Y Bottled Water Tax Hotel. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income.

You are able to use our. Use the Tax Rate Database to determine the rate. So if the room costs 169 before tax at.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

How To Calculate Sales Tax For Your Online Store

No Matter How Much The Tax Rate Changes One Thing Remains Same The Relaxing Comfortable And Delicious Moments At Efcee Saro Portico Hotel Stay Luxury Hotel

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Mcdonald S Speedee Sign And Logo 1953 1962 Mcdonald S Restaurant Senior Discounts Mcdonalds

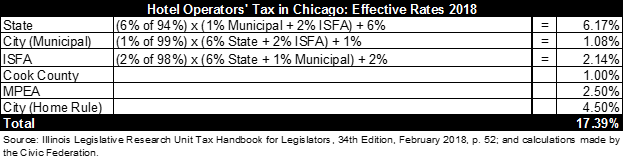

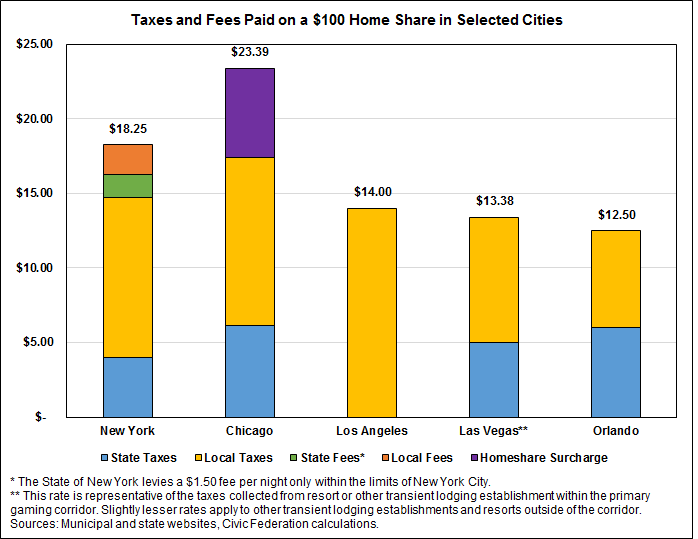

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

How Do State And Local Sales Taxes Work Tax Policy Center

Maps Directions Elkhart Lake Wi Elkhart Lake Wisconsin Getaways Elkhart

Invoice Template Nz Blank Invoice Template Tax Invoice Template For New Zealand Invoice Template Invoice Template Invoice Example Invoicing Software

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Accuratetax Com Sales Tax Automation Solutions For E Commerce Businesses E Commerce Business Tax Software Solutions

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Parade Training Underway 38 North Informed Analysis Of North Korea In 2022 Train Activities Photo Report Parades

Australia High Rise Building High Rise Building Australia Building Construction

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Hotel Operators Occupation Tax Excise Utilities Taxes

Top 10 Most Exclusive Credit Cards In The World Carte Bancaire Cartes Carte